Who Invented the Credit Card? The Story Behind the Plastic in Your Wallet

Aanjelo Salgado - With Gemini & Perplexity AI

Aanjelo Salgado - With Gemini & Perplexity AI

That thin piece of plastic in your wallet feels like a modern invention, but the idea of paying without cash is over a century old. The journey from clunky metal plates to the contactless cards we use today is a fascinating story of convenience, technology, and a little bit of forgetfulness.

The Pre-Plastic Era: Charge Plates and Coins

Long before plastic, in the early 1900s, large department stores offered "charge-plates" and "charge-coins" to their wealthy customers. These were small metal tokens, often with a hole to fit on a keychain, embossed with the customer's account number. When making a purchase, a clerk would use the plate to imprint the customer's details onto a sales slip. It was a system built on trust and was limited to a single store.

An early charge plate, the precursor to the credit card. (Source: digibarn.com)

The "First Supper" and the Birth of the Credit Card

The modern credit card was born from an awkward moment. In 1949, a businessman named Frank McNamara was dining at a restaurant in New York City when he realized he had forgotten his wallet. The embarrassment sparked an idea: a single card that could be used at multiple establishments.

A year later, in 1950, he returned to the same restaurant and paid with a small cardboard card, known as the Diners Club Card. This event is famously called the "First Supper." The Diners Club was a "charge card," meaning the full balance had to be paid at the end of the month. It was initially accepted at just 27 restaurants in New York but quickly grew, laying the groundwork for the universal credit card.

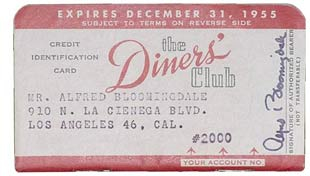

The original Diners Club card. (Source: historyofinformation.com)

The first Diners Club cards were made of cardboard. It wasn't until 1955 that the first plastic card was introduced.

Bank of America and the Rise of Revolving Credit

The next major leap came in 1958 when Bank of America launched the BankAmericard. Unlike the Diners Club card, this was the first successful general-purpose credit card that offered "revolving credit," allowing customers to carry a balance from month to month.

To kickstart the program, the bank famously conducted the "Fresno Drop," where they mass-mailed 60,000 active, unsolicited BankAmericards to residents of Fresno, California. The experiment was chaotic, with high rates of fraud, but it proved the concept worked. The BankAmericard would later evolve and be renamed Visa.

The Debit Card: Direct Access to Your Money

The debit card has a slightly different origin, evolving from ATM cards. The first ATM was introduced in London in 1967. As banks began connecting their ATM networks in the 1970s and 80s, they realized the same technology could be used for point-of-sale purchases.

Unlike a credit card, which is a form of loan, a debit card gives you direct access to the funds in your bank account. This concept of "pay now" became incredibly popular for everyday purchases, offering the convenience of a card without the risk of accumulating debt.

From Magnetic Stripes to Secure Chips

For decades, the magnetic stripe (magstripe) was the standard. Developed in the 1960s, it stored your account information on a simple magnetic strip. However, it was easy to copy, leading to widespread fraud.

This led to the development of the EMV chip (Europay, Mastercard, and Visa). The microchip on your card creates a unique transaction code every time you use it, making it nearly impossible to counterfeit. This "Chip and PIN" or "Chip and Signature" system is now the global standard.

Today, with contactless technology, we don't even need to insert our cards. A simple tap is enough. From metal plates to tapping our phones, the way we pay has changed dramatically, making it more important than ever to track our කාසි and understand where our money is going.